estimated tax refund 2022 calculator

In 2022 Americans are receiving an average of 3536 on their tax refunds according to the latest data from the Internal Revenue Service IRS. You can calculate your 2022 take home pay based of your 2022 gross income Education Tax NIS and income tax for 202223.

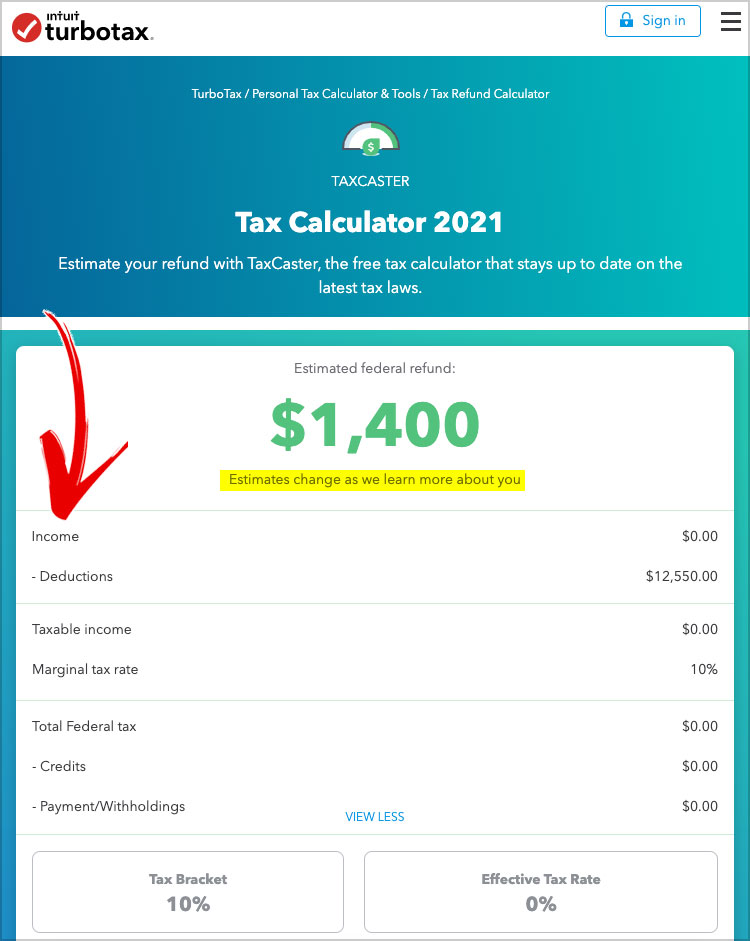

Tax Calculator Figure Your 2021 Irs Refund Before Filing Your Return

THE 2022 tax season continues and some may be curious to find out how much they will get ahead of filing.

. Start with a free eFile account and file federal and state taxes online by April 18 2022. Heres how to open your already-filed return back up to go through the estimated taxes interview calculate estimated tax payments and print out 2022 Form 1040-ES vouchers if desired. The HR Block tax calculator 2022 is available online for free to estimate your tax refund.

The Indian 2022 Tax Calculator is updated for the 202223 assessment year. It is not your tax refund. For the tax calculators below be sure to have your 1099 or W-2 form handy and be ready to answer a few basic questions about your filing status income deductions and credits.

If you don. Loans are offered in amounts of 250 500 750 1250 or 3500. Terms and conditions may vary and are subject to change without notice.

The 1040ES quarterly estimates are due April 18 June 15 Sept 15 and Jan 17 2023. Use this 2021 Tax Calculator to estimate your 2021 Taxes. This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022.

This is an optional tax refund-related loan from MetaBank NA. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Last Updated on Mar 24 2022.

The Canada Annual Tax Calculator is updated for the 202223 tax year. Max refund is guaranteed and 100 accurate. And is based on the tax brackets of 2021 and 2022.

You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax TablesUse the simple annual Canada tax calculator or switch to the advanced Canada annual tax calculator to review NIS payments and income tax. You have nonresident alien status. How to calculate your tax refund.

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. Up to 10 cash back Estimate your 2021 - 2022 federal tax refund for free with TaxSlayers tax refund calculator. You are the beginners it doesnt matter because all apps are designed with a full guide and helping tutorial a.

How to calculate Federal Tax based on your Annual Income. Approval and loan amount based on expected refund amount eligibility criteria and underwriting. Earned Income Tax Credit Estimator.

Calculate your refund fast and easy with our tax refund estimator. Estimate your tax withholding with the new Form W-4P. Federal Taxes or Personal Deskop HB Other Tax Situations.

Free tax filing for simple and complex returns. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. Use any of these 10 easy to use Tax Preparation Calculator Tools.

Ad Get Reliable Answers to Tax Questions Online. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. This includes alternative minimum tax long-term capital gains or qualified dividends.

Your state will also have their own estimate forms. Tax Deductions and Tax Credits Explained Remember that a tax deduction reduces your taxable income cutting your tax bill indirectly by reducing the income thats subject to a marginal tax rate. Certified Public Accountants are Ready Now.

Ad Free means free and IRS e-file is included. Decide everything yourself and be smart with the all-time very Best iPhone apps Tax return estimator and Tax calculator iOS app Also available for other mobile or desktop platformsYou dont have accounting knowledge. You said you have already filed your 2021 return.

Use the simple 2022 tax calculator or switch to the advanced 2022 tax calculator to review NIS payments and income tax deductions for 2022. 100 of the tax shown on your 2021 federal tax return only applies if your 2021 tax return covered 12 months - otherwise refer to 90 rule above only. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022.

A tax return calculator takes all this into account to show you whether you can expect a refund or not and give you an estimate of how much to expect. The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison. You should be able to go through the 2022 estimated taxes interview in Online TurboTax.

Estimate Your 2022 Tax Refund For 2021 Returns. It is mainly intended for residents of the US. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

We strive to make the calculator perfectly accurate. Computes federal and state tax withholding for paychecks Flexible hourly monthly or annual pay rates bonus or other earning items. This calculator is for 2022 Tax Returns due in 2023.

File Your Tax Returns With Confidence And Get Your Taxes Done Right With TurboTax. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. 1040 Federal Income Tax Estimator.

Ad Earn Your Maximum Refund When You File Your Returns With TurboTax. See Publication 505 Tax Withholding and Estimated Tax. The provided information does not constitute financial tax or legal advice.

Your tax situation is complex. Use this free tax return calculator to estimate how much youll owe in federal taxes using your income deductions and credits in just a few steps. Guaranteed maximum tax refund.

Form W-4 and Estimated Taxes - Click the Start or Update button. Use Notice 1392 Supplement Form W-4 Instructions for Nonresident Aliens. Given that this tool comes in handy we wanted to break down the HR Block Tax Calculators process and provide a little education on how the HR Block Tax Calculator works.

To calculate your federal quarterly estimated tax payments you must estimate your adjusted gross income taxable income taxes deductions and credits for the calendar year 2022. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Tax Refund Estimator Calculator For 2021 Return In 2022

Quarterly Tax Calculator Calculate Estimated Taxes

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Year 2022 Calculator Refund Estimate E File Returns

H R Block Tax Calculator Free Refund Estimator 2022

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

2022 Irs Tax Refund Dates When To Expect Your Refund Cpa Practice Advisor

Estimate Your Tax Refund With The Turbotax Taxcaster The Turbotax Blog

H R Block Tax Calculator Free Refund Estimator 2022

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Tax Calculator Estimate Your Income Tax For 2022 Free

Excel Formula Income Tax Bracket Calculation Exceljet

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

Tax Year 2022 Calculator Refund Estimate E File Returns

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More